Tutorial 25: How to setting tax On OpenCart Online Store

OpenCart is a powerful and user-friendly open-source e-commerce platform that allows merchants to setting taxes. The taxes section in Localisation allows the administrator to create the taxes that will be applied to specific products in the store. Here's how to set tax setting for your OpenCart online store.

The goal of this article is to display tax price and non tax price at the same time.

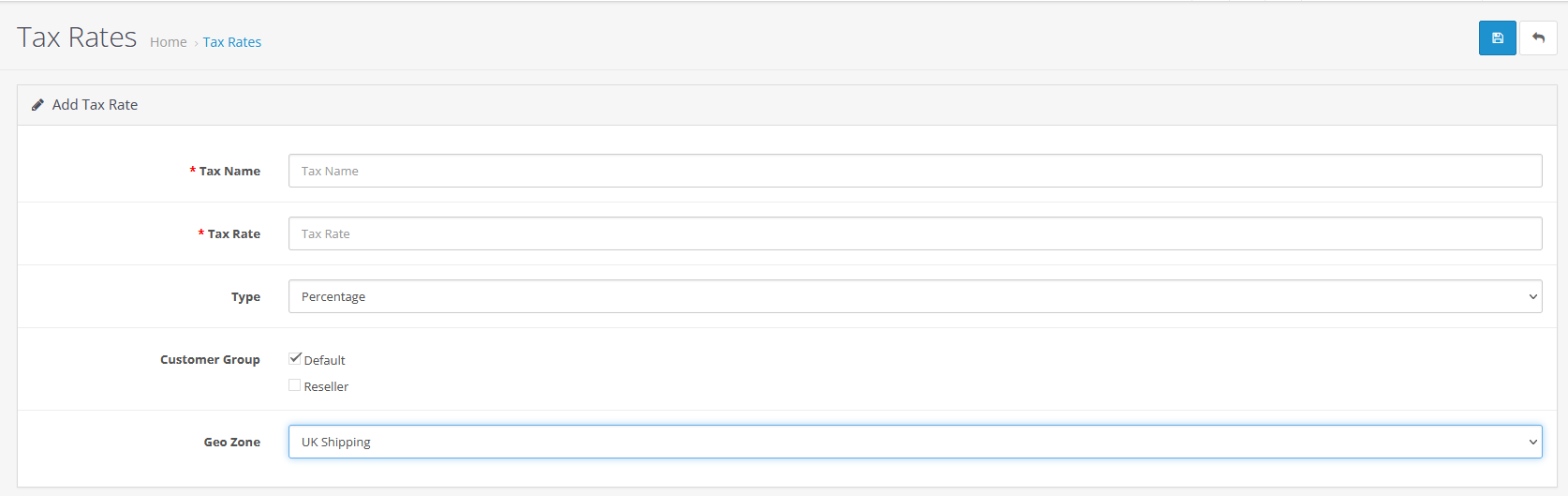

Step 1: Setting Tax Rates

The tax rate will be used to calculate the tax on an order. This tax rate information is needed for use in tax classes.

- Goto Systems -> Localisation -> Taxes -> Tax Rates

- Add tax rates by clicking the add button in the top right corner.

- Tax Name: A name for the tax that will be displayed in the store front when taxes are added to order total.

- Tax Rate: A number value for the tax.

- Type: Determines whether the number value in Tax Rate is a fixed amount or a percentage of the total amount of an order.

- Customer Group: Selecting a customer group will add this tax to all the customers within this group. Multiple customer groups can be selected at once.

- Geo Zone: Selecting a Geo Zone will apply the tax to the regions and countries within a Geo Zone.

- After filling in the tax rates data form then save. Your tax rates data will appear in the tax rates list.

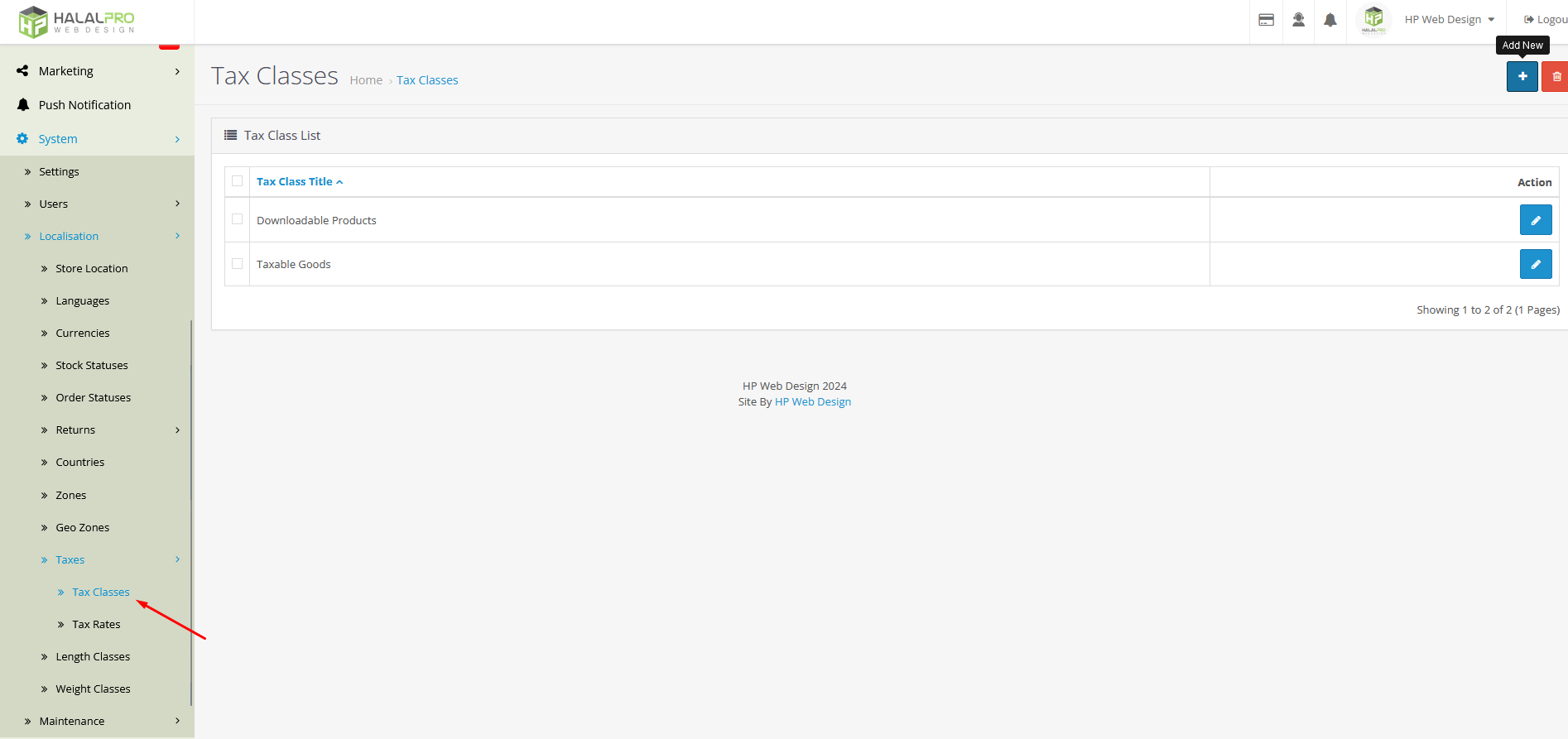

Step 2: Setting Tax Classes

Tax classes are used to store multiple tax rates into one category. Tax can be adjusted to calculate tax based on payment address (customer), shipping address (customer) or store address.

- Goto Systems -> Localisation -> Taxes -> Tax Classes.

- Add tax classes by clicking the add button in the top right corner.

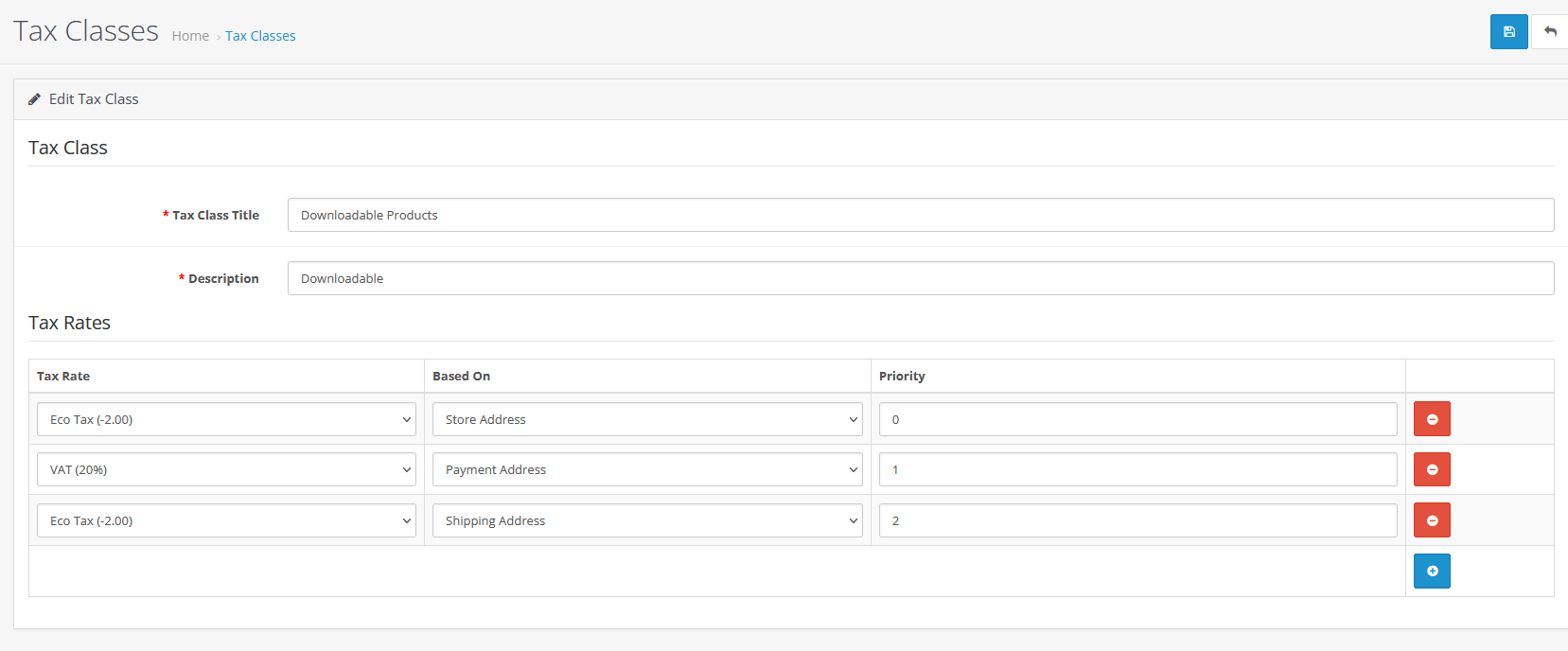

- Tax Class Title: Title for tax class.

- Description : Description for tax class.

- Tax Rate: selecting "Add Rule" will add a tax rate that was created in Tax Rates. Base On requires either the payment address, shipping address or the store address to be selected. This will determine the amount of tax added to the shopping cart total in the store front. Priority determines the position of the tax rate if other tax rates are listed with it.

- After you add a tax class, you can enter tax on each product by selecting the tax class that has been set.

Thanks for taking the time to follow this tutorial. We appreciate your visit and hope that this tutorial has added value to your experience in managing your online store. If you have further questions or need additional assistance, please don't hesitate to contact us. I hope your online shop will be more successful and known by many people.